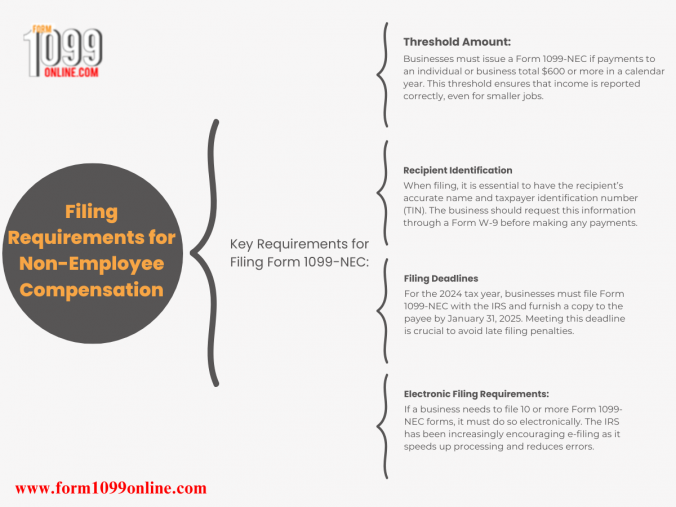

Businesses must file Form 1099-NEC for payments totaling $600 or more annually, requiring the recipient's accurate name and TIN. For the 2024 tax year, the filing deadline is January 31, 2025, and electronic filing is mandatory for 10 or more forms. Staying compliant helps avoid penalties and ensures accurate income reporting.

-

- Categories

- Architecture

- Art

- Cars & Motorcycles

- Design

- DIY & Crafts

- Education

- Film, Music & Books

- Fitness

- Food & Drink

- Gardening

- Geek

- Hair & Beauty

- History

- Holidays & Events

- Home Decor

- Humor

- Kids

- Women's Fashion

- Men's Fashion

- Leisure & Outdoors

- People

- Photography

- Products

- Science & Nature

- Sports

- Technology

- Travel & Places

- Weddings

- Other

- Property

- Animal

- Celebrities

- Health & Fitness

- Illustrations & Posters

- Quotes

- Services

- Renovation

- Home Building

- Business

- Toys

- New

- Popular

- Gifts

- Videos

- Help / Contact Us

- Terms & Privacy

- What is InterestPin